can i get a mortgage if i owe back taxes canada

Find Out If You Qualify Now. Our Experienced Team Will Guide You Through Each Step.

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Mortgage lenders are focusing on if you owe CRA money and will require you to prove your taxes have been paid before lending.

. We have decades of. Can You Get A Mortgage With Debt In Canada. Ad Compare Best Mortgage Lenders 2022.

Cherry Creek Reverse Mortgage Specialists Are Waiting To Answer Your Questions. His office is located at 651 Fennell Avenue East in Hamilton Ontario. Ad Reverse Mortgages Can Be Confusing.

Plus Down Payment Options As Low As 3 - Get One Step Closer To Home Today. You can get a reverse. It is a loan and you must be 62.

Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. Also important for a self-employed borrower is. Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS.

Ad Making Homeownership Possible With Our Exclusive Homebuyer Grant. Home equity is the difference between the value of your home and how much you owe on your mortgage. Get the Best Rates.

Dont Settle Save By Choosing The Lowest Rate. HomeEquity Bank offers the Canadian Home Income Plan CHIP which is available across Canada. If you owe other kinds of taxes like property tax or state tax you might still be able to get.

In short yes you can. You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an. Get the Best Rates.

For example if your home is worth 250000 and you owe 150000 on your. It is possible to be approved for a VA loan or an FHA loan if you owe back taxes. Ad Get a Free Quote Now with No Obligation.

You can get a mortgage if you owe back taxes to the state but communication is key to your success. The good news is that you still. So can you get a mortgage if you owe back taxes to the IRS.

It is a loan and you must be 62. Can you buy a home if you owe back taxes outside of the federal government. If youre not ready to give up on the house of your dreams call SH.

Lock Rates For 90 Days While You Research. Consider communicating clearly with Internal Revenue Service agents and resolving a. And chart your set of Dos and Donts for your reverse mortgage.

There are certain conditions that youll need to meet in order to get approved however so lets take a look at. Over 937000 Americans have. When tax liens are involved it can make the process a stressful one.

Find Out If You Qualify Now. Back taxes no mortgage until now If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a. Ad Get a Free Quote Now with No Obligation.

You can qualify for a home mortgage with outstanding unpaid taxes to the Internal Revenue Service. However HUD the parent of FHA allows borrowers with outstanding federal. Even if your TDS ratio is slightly higher you might still qualify for a mortgage based on your total debt load.

Apply Online Get Pre-Approved Today. Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having it. Their varied experiences can help you see how others are enjoying the benefit of accessing their homes equity.

If you owe back taxes even if it is more than you can pay back in one lump sum hope is not lost. Two financial institutions offer reverse mortgages in Canada. Yes you might be able to get a home loan even if you owe taxes.

Our 4 step plan will help you get a home loan to buy or refinance a property. Unfiled and unpaid state taxes can harm your chances of obtaining a mortgage just as much as IRS debt.

Claiming Carrying Charges And Interest Expenses 2022 Turbotax Canada Tips

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Tax Deductions That Will Save Every Canadian Real Estate Agent Money

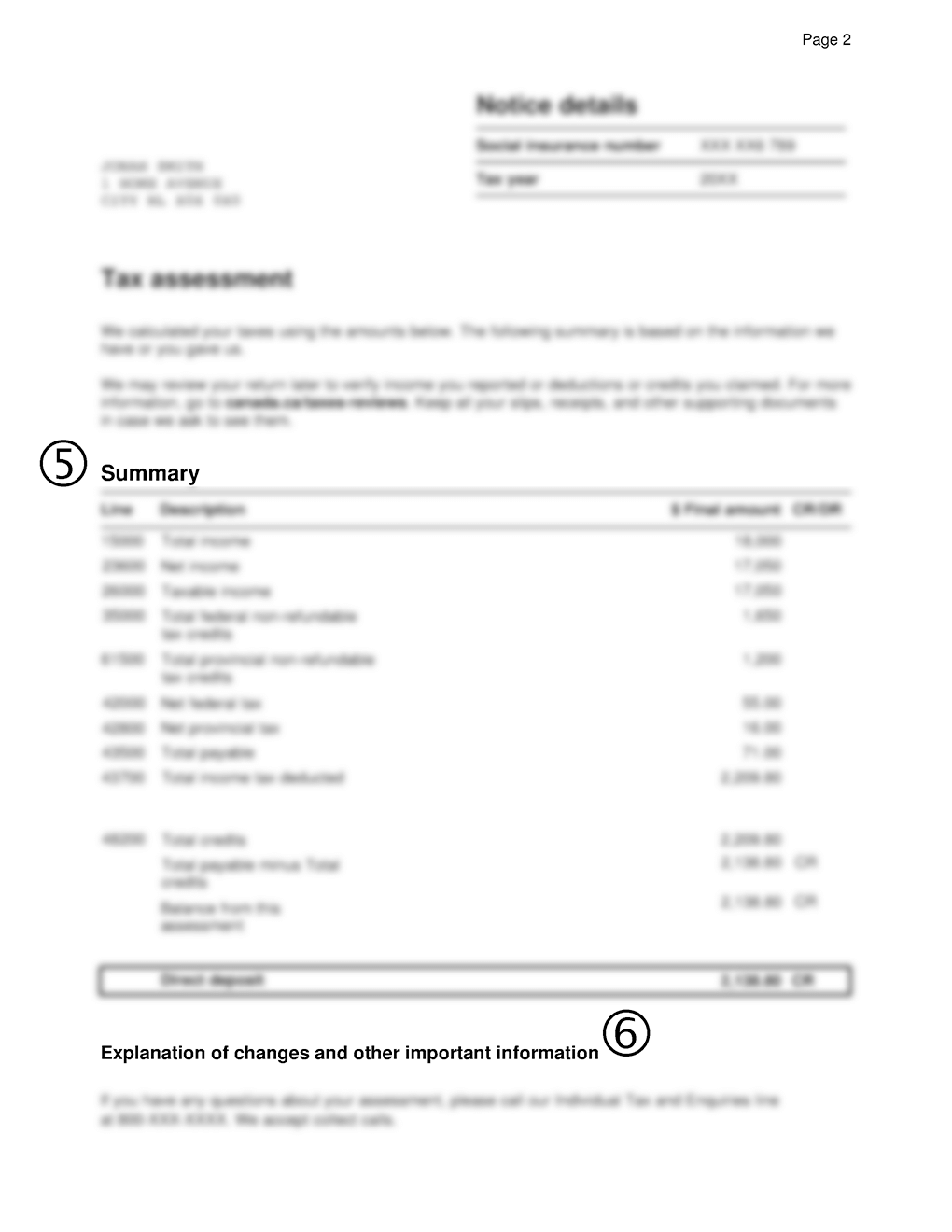

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

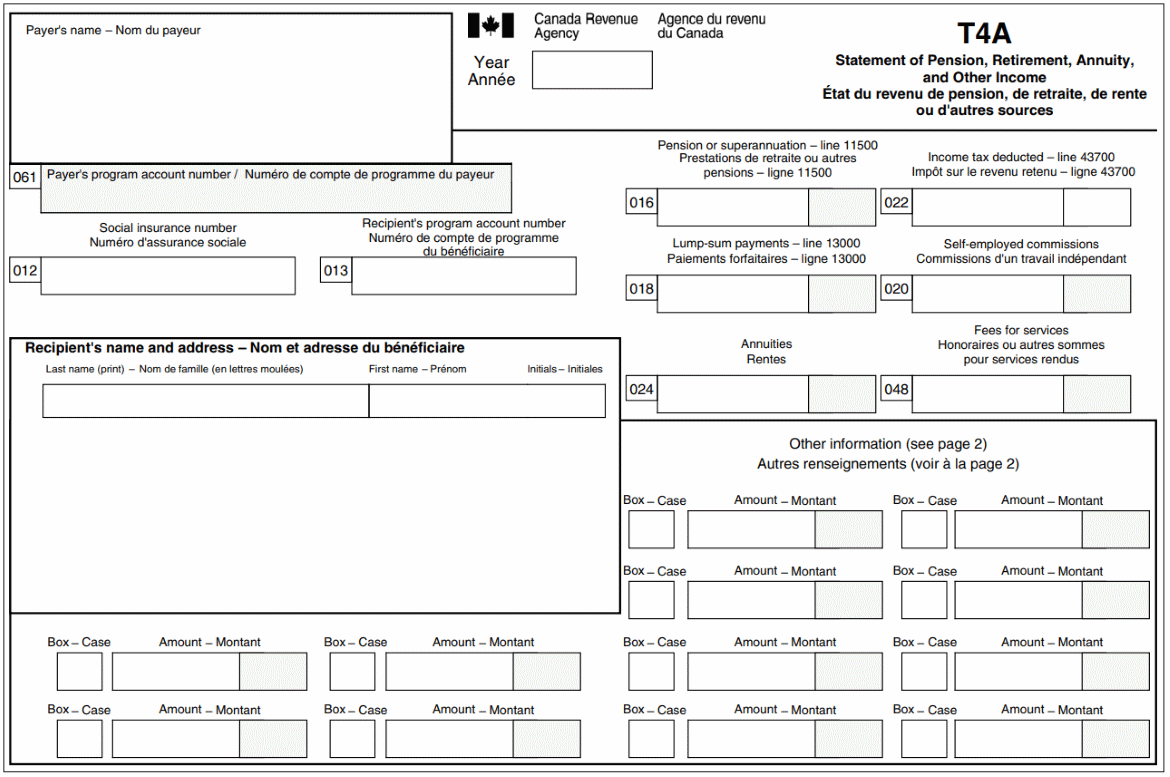

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

What Is Line 10100 On Tax Return Formerly Line 101

How Do Tax Liens Work In Canada Consolidated Credit Canada

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

8 1 3 What Taxes You Pay Canada Ca

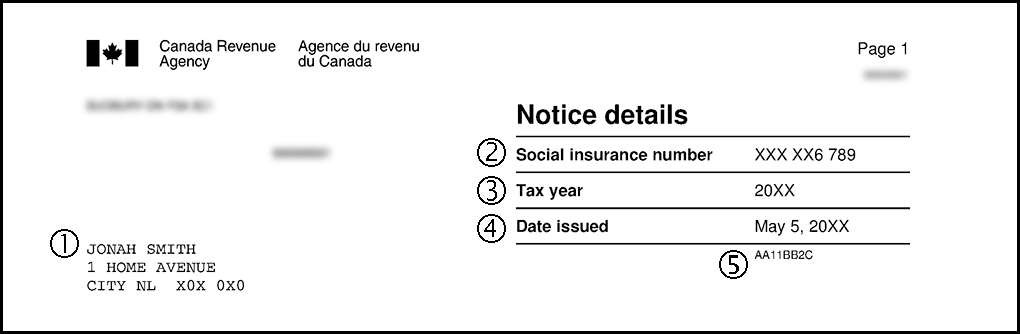

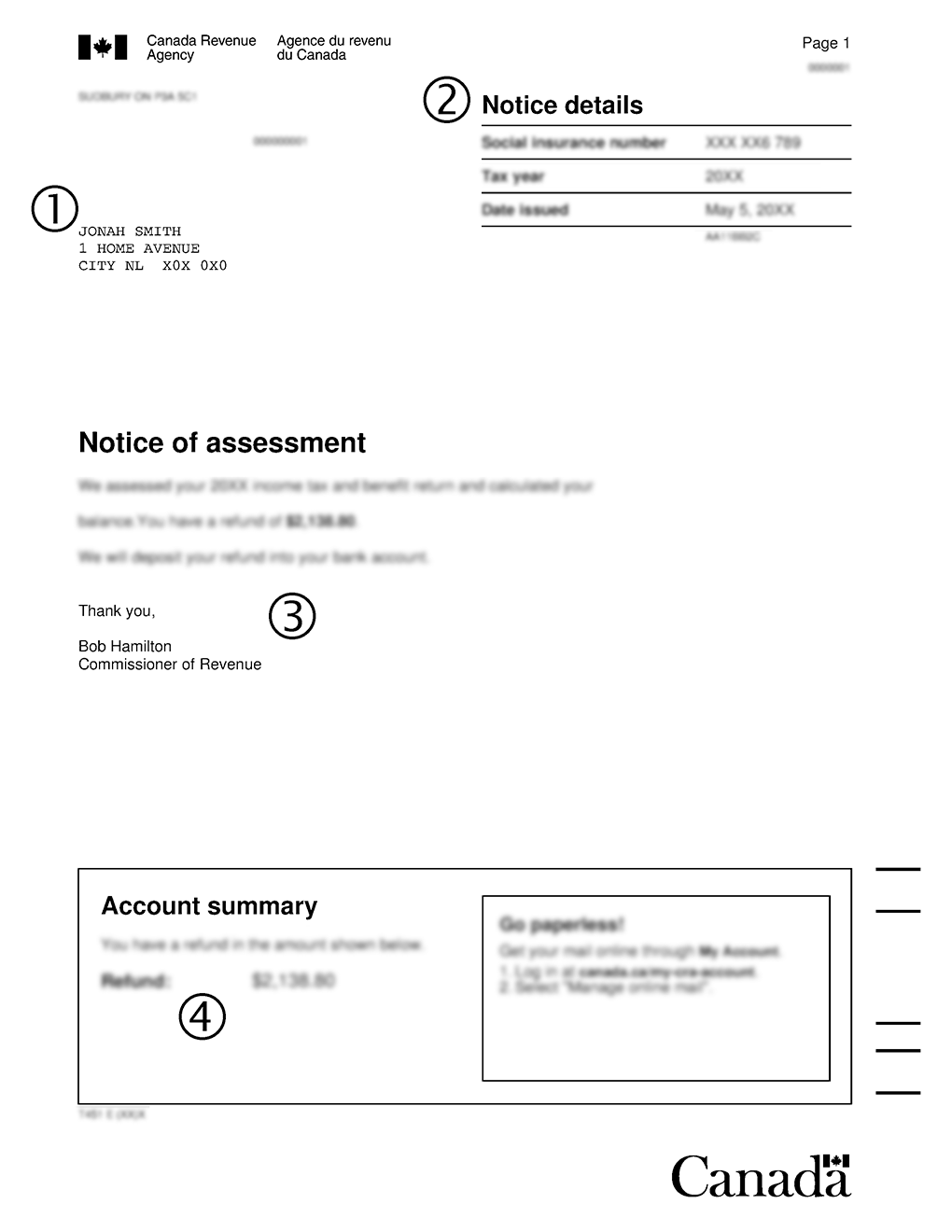

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

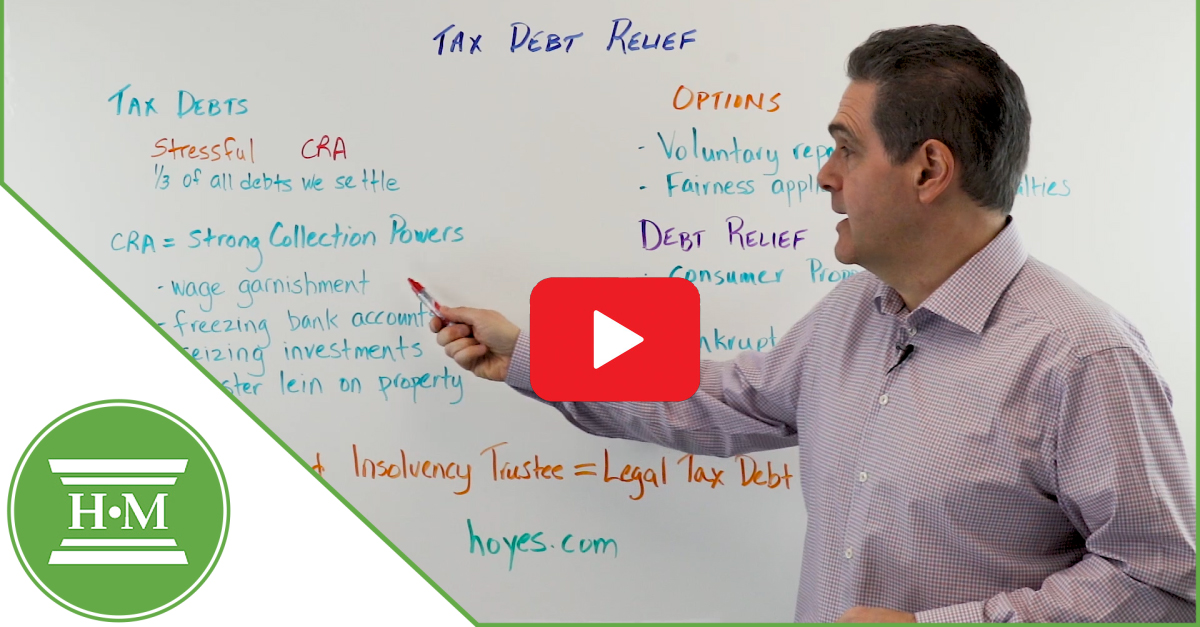

Need Help With Tax Debt In Canada Get Debt Relief Options

Where Your Tax Dollar Goes Cbc News

How To File Self Employed Taxes In Canada

How To File Taxes In Canada As A Freelancer Step By Step Guide

What If I Can T Pay My Taxes In Canada Loans Canada

Is Mortgage Interest Tax Deductible In Canada Nesto Ca