car lease tax california

At the end of the lease you would pay salesuse tax on any buyout option that you elect to exercise if there is one. How Much Is the Car Sales Tax in California.

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

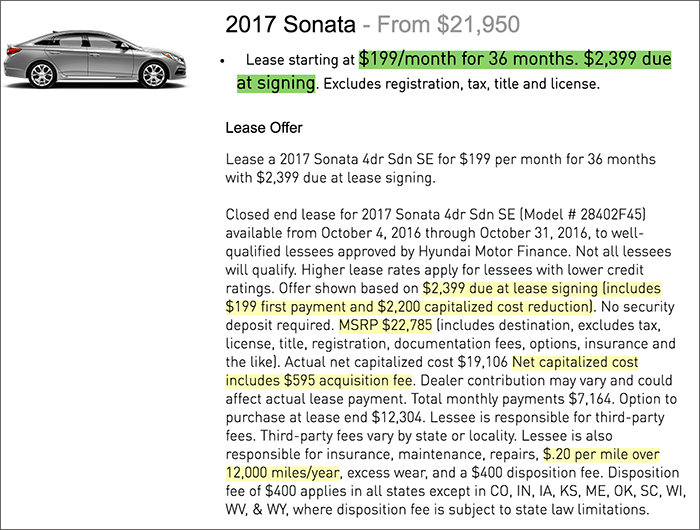

In California the tax on a lease is levied on the monthly payment and any ceiling reduction.

. The California State Board of Equalization Board has promulgated Regulation 1660 which explains the law as it applies to leased property in general and transactions that may look like. The California vehicle tax is 75 percent but this simple number only gives you a rough idea of what youll really pay for a new car. The act governs transactions between vehicle lessors and lessees.

Its sometimes called a bank fee lease inception fee or. I chose to lease a MY. Beginning January 1 2021 certain used vehicle dealers are.

For example if you previously paid 1500 sales or use tax to another state for the purchase of the vehicle and the California use tax due is 2000 the balance of use tax due to California would. On June 29 2020 California passed Assembly Bill AB 85 Stats. This means you only pay tax on the part of the car you lease not the entire value of the car.

In CA you have 10 days to transfer the title to the new owner with all fees paid in order to not pay taxes on lease buyout. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. The 10 day window is the easiest way to execute the transaction with the DMV.

While Californias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Section 2987 of the California Civil Code is the Moscone Vehicle Leasing Act. Love the car so far.

For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6. Remember automobile sales tax is collected by the DMV on behalf the tax authorities in. For vehicles that are being rented or leased see see taxation of leases and rentals.

This means that salesuse tax applies to your down-payment if any and to each monthly lease payment. If you dont buy the vehicle at the end of the lease you may have to pay a disposition fee to return the vehicle. 8005 Collection of California Sales Tax.

8 and AB 82 Stats. The states overall sales taxes vary by. As evidence of a.

From a multistate tax planning perspective one of the most important points to know is that leased property located outside of California is considered tax exempt. I just received my first monthly lease bill and it was a little higher than originally stated. Multiply the base monthly payment by your local tax rate.

This page covers the most important aspects of Californias sales tax with respects to vehicle purchases. The only way to get extra taxes would be if you got some kind of discount. Sells the vehicle within 10 days use tax is due only from the third.

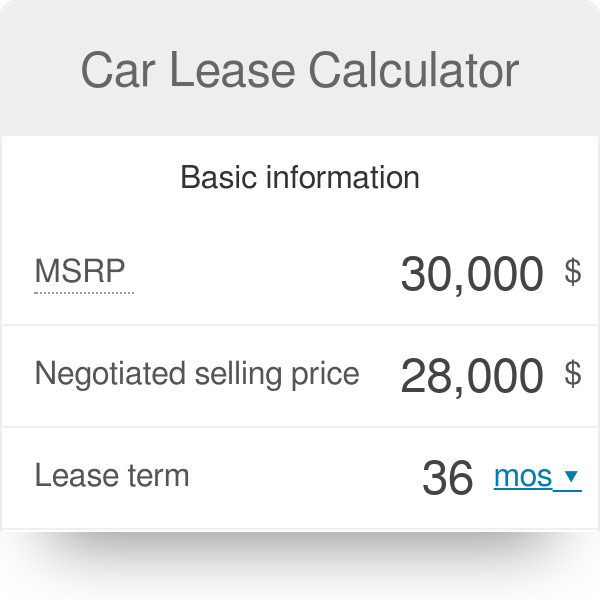

Things to consider before leasing. I emailed Tesla Financial about it and the. A car lease acquisition cost is a fee charged by the lessor to set up the lease.

So on the 1948 sales tax that you mentioned about 155 to 180 of that is due to the 2000 decrease that you alluded to. Under the California Code. The most common method is to tax monthly lease payments at the local sales tax rate.

Sales tax in California varies by location but the statewide vehicle tax is 725. So on the 1948 sales tax that you mentioned about 155 to 180 of that is due. Revisit the dealership that sells the vehicle you wish to lease.

Negotiate a sales price for the vehicle with the car salesman aiming for the lowest price possible starting from. Gluck December 26 2018 1142pm 8. Acquisition Fee Bank Fee.

Of the 725 125 goes to the county. In California the tax on a lease is levied on the monthly payment and any ceiling reduction. This page describes the taxability of.

8010 Completing the Report of Sale-Used Vehicle REG 51 8015 Corrections on the Report of Sale-Used Vehicle REG 51. But typically salesuse tax for a leased vehicle in California is pay-as-you-go.

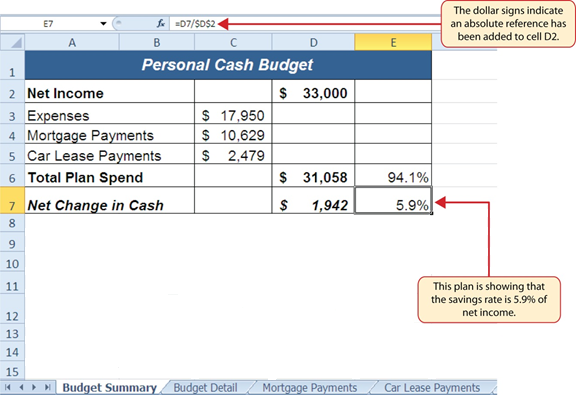

2 3 Functions For Personal Finance Beginning Excel First Edition

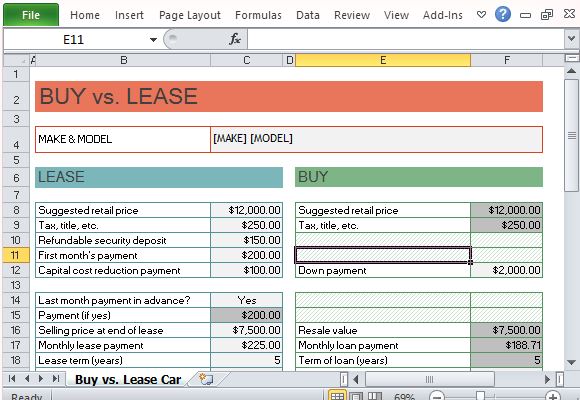

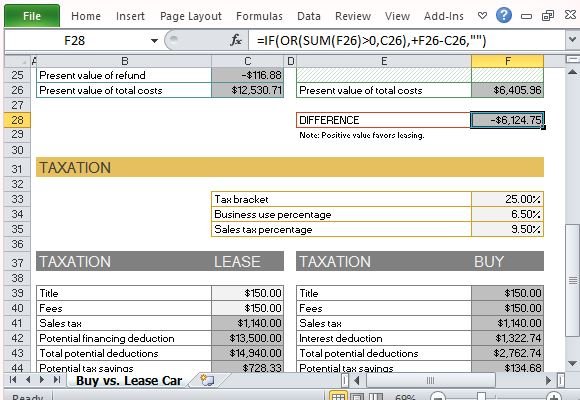

Car Buy Vs Lease Calculator For Excel

How To Negotiate Your Next Car Lease Like A Pro

Car Buy Vs Lease Calculator For Excel

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

Company Cash Allowance Vs Company Car Vanarama

Early Lease Termination Option B Bimmerfest Bmw Forum

How Does Leasing A Car Work Earnest

Car Lease Calculation Template Car Lease Calculation

/GettyImages-185274181-80022fa82eed40ff80bf97b745b9320c.jpg)

Buying Vs Leasing A Car Pros And Cons Of Each

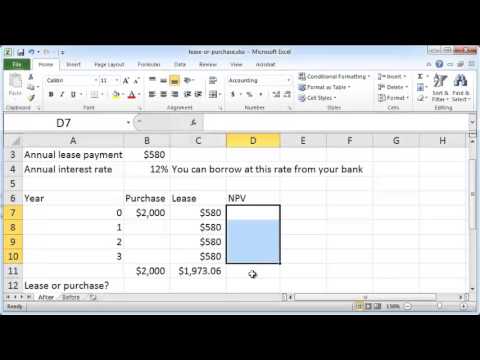

Excel 2010 Buy Versus Lease Calculation Youtube

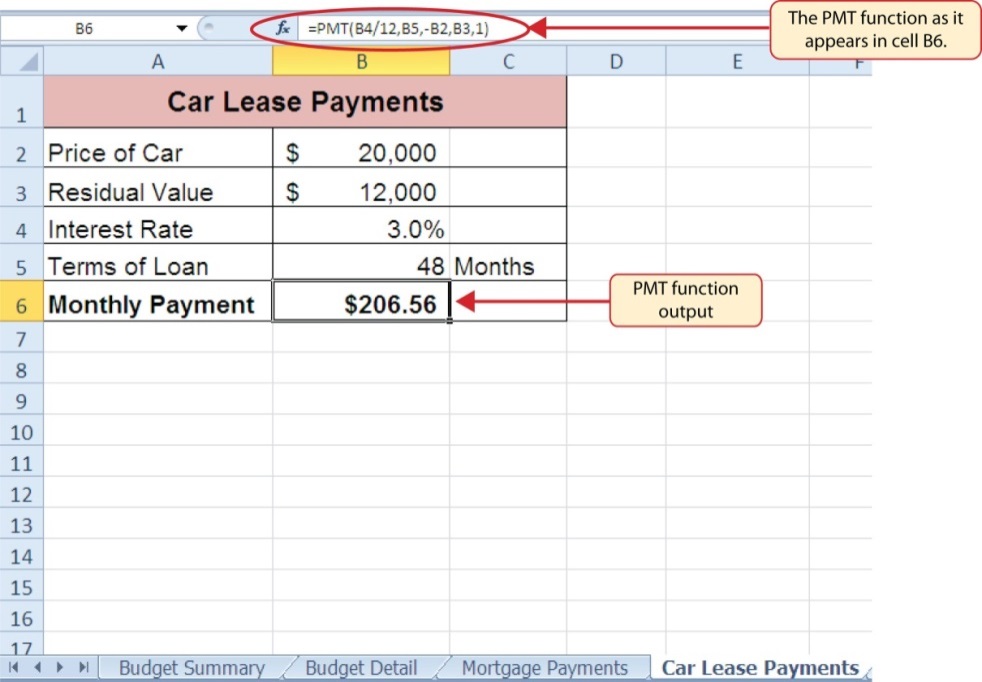

9 2 The Pmt Payment Function For Leases Excel For Decision Making

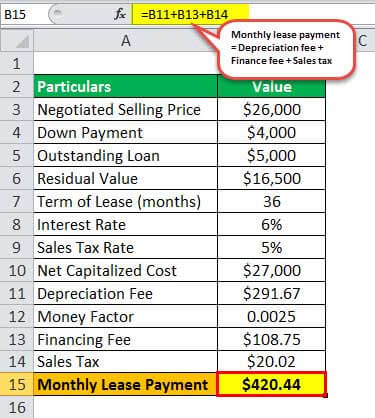

How A Lease Payment Is Calculated

Lease Payment Formula Explained By Leaseguide Com

Lease Payment Formula Example Calculate Monthly Lease Payment